“There’s no nobility in poverty.” This epic dialogue from The Wolf of Wall Street shows the ambition and hunger for success that people nowadays have. While being ambitious is good, making your ambitions come true takes a lot of consideration. Your journey might begin with choosing the right course. One that could offer you financial freedom and a career with excellent salary packages. According to sources, over one lakh students enrol in a BBA course every year.

Most opt for a BBA in Finance, making it one of the most sought-after BBA specialisations. Besides, admissions in BBA are growing at a CAGR of 13.29% rate, annually. With this blog, we shall provide you with an explicit overview of a BBA in finance programme. You would learn about its curriculum, top colleges offering BBA in finance, the admission process, career options, etc. Dig into the blog to discover more intriguing details about BBA in finance and why you must choose this course. So, let’s begin.

What is a BBA in Finance? A Precise Overview

BBA or Bachelor of Business Administration in Finance, is an undergraduate course, spanning three years. Enrolling in this course offers you exposure to finance, banking, insurance, budgeting, and investments, among others. This is one of the BBA’s popular specialisations as the financial department is a crucial sector of every organisation.

Furthermore, in this course, you would study portfolio management, business communication, financial analysis, and investment analysis subjects. However, what careers does this programme offer? How does pursuing a BBA in finance worth it? What’s the curriculum of this course? Such queries might be rattling around your mind. So, before learning about the potential careers after a BBA in finance, let’s explore the benefits of pursuing a BBA in finance.

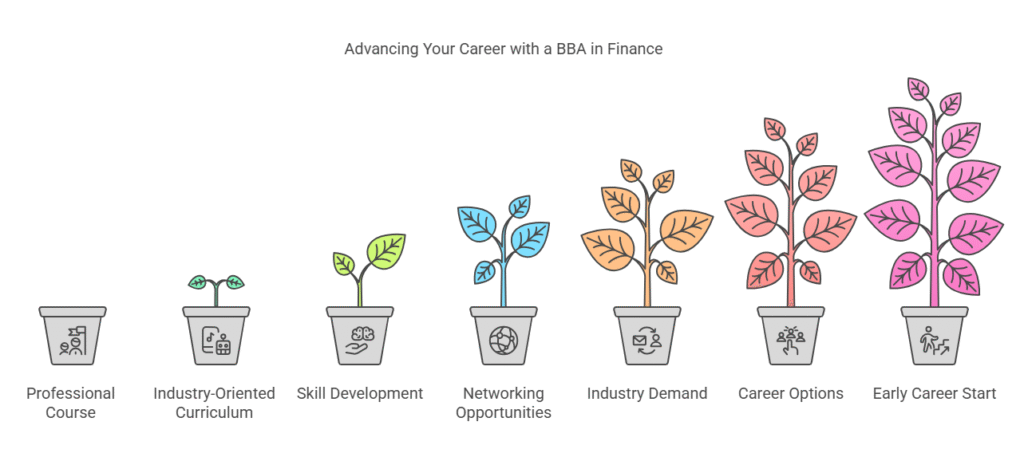

Why Must You Pursue a BBA in Finance? Top 7 Benefits

Benefits speak louder than words 📢

Here are the top benefits of a BBA in finance course. These are the reasons that ensure that pursuing a BBA is worthwhile. Let’s explore them in a glimpse:

📚 Professional Course: BBA is a professional undergraduate degree focused on the principles of businesses. Opting for a specific specialisation in finance makes it a career-oriented programme, beneficial from the perspective of industry demands.

📑 Work & Industry-Oriented Curriculum: It incorporates an industry-centric curriculum. The current market looks for young aspirants with industry-centric professional courses. A BBA in finance prepares you for real-world job roles in various companies, especially finance-based ones.

🤹 Skill Development & Practical Learning: Gone is the time when degrees were preferred over skills. Nowadays, employers seek skilled young candidates. BBA in finance course focuses on skill development with its practical learning approach. In this course, you would gain the following:

🔹 Business Communication

🔹 Analytical Reasoning

🔹 Financial Analysis

🔹 Networking

🔹 Strategic Thinking

🔹 Decision-making and Problem-solving

🌐 Networking Opportunities: Since it’s a finance-focused professional business course, it offers you numerous networking opportunities. Industrial visits, seminars from industry experts, and alumni interaction are several networking programmes offered in this course.

🏭 Industry Demands: This is an in-demand course since it focuses on skill development. As a skilled candidate with a BBA in finance, you could work in manufacturing, banking, insurance, finance, and even in IT and healthcare industries.

🔢 Numerous Career Options: Every organisation needs skilled finance candidates with professional courses. The programme offers a variety of job roles in various companies, such as financial analyst, budget analyst, and investment banker.

⌛ Begin Your Career Ahead of Time: Most regular courses obligate you to pursue a follow-up master’s degree to kickstart your career. This is a professional course, and with it, you could begin your career efficiently without a master’s programme.

Types of BBA in Finance Course: Learning with No Barriers

In the past years, the education system has evolved a lot. Every course is available in various types nowadays. To cater to your different requirements, institutions offer you many kinds of courses. It helps you balance your needs and studying. Let’s explore the types available in a BBA in finance courses. You could choose your desired type based on your needs. Here they are:

1️⃣ Full-time BBA in Finance: This is a regular course you must attend on campus. It’s a full-time programme, and you must attend the classes regularly.

2️⃣ Part-time BBA in Finance: Some institutes offer you a part-time BBA in finance. It is for people who couldn’t make it through full-time attendance on campus.

3️⃣ Online BBA in Finance: Just like the regular programme, it is a full-time course but you don’t need to visit the campus for classes. These are conducted through online mode, and your lectures would be updated daily on a digital platform.

4️⃣ Distance BBA in Finance: It allows you to accomplish your degree without attending the campus. Your online lectures are updated regularly, whereas, in the distance, the classes are held on weekends only through online mode.

5️⃣ Integrated BBA + MBA: This programme offers you the privilege to finish your BBA and MBA together. Therefore, you don’t need to find colleges or take year gaps to finish your master’s.

6️⃣ Specialised BBA in Finance: Finance is already a specialisation in BBA. A specialised BBA in finance further provides you with options to choose your desired niche in finance. It is an expertise-focused course, emphasising expert skills in a particular area.

BBA in Finance: General Syllabus

BBA is an undergraduate course. Most universities usually offer you a 3-year BBA programme. However, a few universities might provide a 4-year BBA programme. Based on the college and curriculum, the syllabus significantly varies. However, here is the general syllabus of the BBA in finance that you could consider:

| Syllabus 1 | Syllabus 2 |

| Business Management | Financial Services |

| Principles of Accounting | Business Communication |

| Principles of Banking | Business Analytics |

| Financial Landscape in India | Retail and Wholesale Banking |

| English Communication | Marketing Management |

| Quantitative Techniques for Management | Organisation Behaviour |

| Syllabus 3 | Syllabus 4 |

| BFSI – Framework | Entrepreneurship |

| Managerial Economics | Macroeconomics |

| Global Banking | Financial Markets & Instruments |

| Environmental Science | Central Banking Functions |

| International Finance | Financial Modelling |

| Capital Markets and Derivatives | Taxation Laws |

| Syllabus 5 | Syllabus 6 |

| Strategic Management | FinTech in BFSI |

| Risk Management and Derivatives | Operations Management |

| Business Ethics and Corporate Governance | Mergers and Acquisitions |

| Financial Reporting and Analysis | Project Management |

| Managerial Effectiveness | Working Capital Management |

| Portfolio Management and Security Analysis | Financial Markets and Institutions |

| *Please note that depending on your institution, many colleges offer electives in their 3rd to 6th semesters. Some of them may include summer internships or workshop programmes. |

BBA in Finance: Minimum Eligibility Criteria

A BBA in finance follows the same eligibility as a BBA course. However, based on institutions, it might differ a bit. Here are the general eligibility criteria for a BBA in finance in various institutions:

✅ You must have a minimum of 50% marks in your 10+2.

✅ Some institutes might allow you for admission with 45% marks in 10+2.

✅ Many institutions finalise BBA admissions based on the CUET UG entrance exam.

✅ Several institutes conduct their specific entrance exams for BBA, such as NMIMS NPAT or MAH BBA CET.

Based on your choice of institution, the eligibility criteria vary. However, you can enrol in a BBA in finance after passing your 10+2 in various institutions.

Enrolling in BBA in Finance: Admission Process

Various institutions follow different eligibility criteria. After fulfilling the necessary eligibility criteria, you could further your admission process. Besides, some institutions take admissions based on entrance exams. Here is a general admission process for a BBA in finance:

✅ Visit the official website of your desired institution.

✅ Navigate for your BBA course and choose the specialisation in finance.

✅ Click on the application form.

✅ Fill out your personal and academic details carefully.

✅ Upload the scanned copy of the essential documents for verification.

✅ Make sure to double-check all your information.

✅ Pay the mandatory registration fee by online payment. It varies for every college and university.

✅ Pay the semester fee online or directly on campus.

Based on the entrance exam:

🔹 Visit the official website of your desired institution and navigate to accepted entrance exams.

🔹 Fill out the application form for the entrance exams, generally, CUET is preferred.

🔹 Take the entrance exam and qualify for it.

🔹 Apply to the institution with your documents and entrance exam scores.

🔹 Attend the interview or counselling process (if applicable).

🔹 Upon selection, pay the semester fee.

🔹 Your admission is confirmed.

7 Careers Prospects & Salary After BBA in Finance

Pursuing a BBA in finance offers you a variety of career options to choose from. Based on your skills and interests, you could step into your desired industry. Besides, the salary packages associated with each career are extremely exciting. Here are several popular careers after a BBA in finance:

| Career Prospects | Average Salary Range |

| Investment Banker | INR 2 LPA – INR 41 LPA |

| Management Consultant | INR 7 LPA – INR 42.7 LPA |

| Financial Analyst | INR 2.1 LPA – INR 12.9 LPA |

| Financial Controller | INR 6.4 LPA – INR 60 LPA |

| Portfolio Manager | INR 3 LPA – INR 38 LPA |

| Cash Manager | INR 0.2 LPA – INR 7 LPA |

| Credit Analyst | INR 2.2 LPA – INR 16 LPA |

Source: AmbitionBox

5 Best Colleges Offering BBA in Finance

Choosing the right college offering you the best BBA in finance curriculum is one of the challenging tasks. In India, there are nearly 43,000 institutions. Searching for the best might seem like finding a needle in the haystack. Therefore, we have narrowed down this list and have mentioned the best five colleges offering BBA in finance. Take a look at them:

| Institution Name | Total Fees | Duration |

| UPES | INR 11,14,000 | 3 Years |

| K.R. Mangalam University | INR 7,40,000 | 4 Years |

| Ahmedabad Institute of Business Management | N/A | 4 Years |

| Parul University | INR 2,40,000 | 3 Years |

| Chandigarh University | INR 5,04,000 | 3 Years |

👉 Please note that some of these institutions offer BBAs in finance with other specialisations, such as BBAs in finance and accounting.

Top 5 Online BBA Colleges in India

BBA is a popular course, available in a range of management specialisations. Nowadays, with emerging online education, employers prefer an online BBA as a regular BBA programme. These courses provide you with location flexibility and allow you to learn at your convenience. Most top-notch colleges and universities are offering you online BBA in numerous specialisations. The esteemed institutions also focus on providing you with career guidance and placement assistance in an online BBA programme. We have gathered the top 5 colleges offering you the best online BBA in India. Let’s explore them:

| Institution Name | Total Fees | Duration |

| Amity University Online | INR 1,65,000 | 3 Years |

| Chandigarh University Online | INR 1,68,000 | 3 Years |

| Jain University Online | INR 1,95,000 | 3 Years |

| Dr DY Patil Vidyapeeth Centre for Online Learning | INR 1,45,400 | 3 Years |

| Online Manipal | INR 1,35,000 | 3 Years |

Top 12 MNCs Hiring BBA in Finance Graduates in India

Top MNCs welcome graduates with a BBA in finance. They look for skilled young candidates who could bring new insights to their organisation. Here are the top MNCs established in India to consider after your BBA in finance:

| Top Recruiters | Top Recruiters |

| Tata Consultancy Services (TCS) | Deloitte |

| Goldman Sachs | Accenture |

| KPMG | Ernst & Young (EY) |

| Infosys | Capgemini |

| ICICI Bank | McKinsey & Company |

| IBM | Genpact |

BBA in Finance Quick Overview: A Programme for Visionaries

“An investment in knowledge pays the best interest.” – Benjamin Franklin

| Parameters | Details |

| Course Name | Bachelor of Business Administration (BBA) in Finance |

| Duration | 3 – 4 Years |

| No. of Semesters | 6 – 8 (based on duration) |

| Course Type | Undergraduate |

| Modes of Learning | Full-time, part-time, online, and distance. |

| Total Fees | INR 2,00,000 – INR 12,00,000 (varies by institution) |

| Minimum Eligibility | Passed 10+2 from a recognised institution with at least 50% marks. |

| Top Colleges | UPES, Chandigarh University, ICFAI University, etc. |

| Course Benefits | Networking, industry-focussed curriculum, numerous career options, etc. |

| Career Prospects | Financial analyst, investment banker, portfolio manager, etc. |

| Top Recruiters | McKinsey & Company, Deloitte, Accenture, Capgemini, etc. |

| Average Salary | INR 2 LPA – INR 45 LPA (based on roles and experience) |

| Further Options | MBA, LLB, MHM, certificates in digital marketing, etc. |

Logging Out

BBA is one of the popular and versatile courses, offering you a plethora of specialisations. Most people opt for BBA in finance due to its high and evergreen industry demands. Pursuing this undergraduate course helps you start your career early, right after your graduation. After completing your BBA in finance, you could pursue an MBA. Or go for certification courses to gain expertise in a specific area.

The course opens your doors to numerous careers in different industries, from BFSI to IT and healthcare. Besides, the popularity of online education is at its peak. By pursuing an online MBA or online certification courses, you could simultaneously pursue a full-time job while continuing your studies. So, what’s your thought on it? Well, think about it later. It’s time to focus on a BBA in finance, whether offline or online.